Quand vient le temps de remplacer leur toiture, de nombreux clients ne disposent tout simplement pas des fonds nécessaires. This is especially true in the wake of the COVID-19 pandemic, when some customers are experiencing furloughs, layoffs, or having their work hours drastically cut.

The good news is that roofing companies don't have to sit idly by waiting for consumers to save money for a roofing project. Vous pouvez offrir à vos clients la possibilité de financer leur toiture. De nos jours, de nombreux achats sont financés, des voitures aux matelas, en passant par les téléphones cellulaires. A lot of companies now advertise the monthly cost, not the total purchase price, of their goods and services because manageable monthly payments tend to be much more attractive to customers than one lump sum.

By offering financing, your company can book jobs during this difficult time and offer your customers a manageable monthly payment. Et cela permet également d'être payé pour le projet immédiatement. Tout le monde y gagne.

Why Offer Roof Financing?

Roof financing is a budget-friendly option for those who might be suffering economic hardships due to the COVID-19 pandemic. Financing provides a way for your customers to get needed repairs done while still being able to afford their living expenses.

You may find that a payment plan helps attract more new customers overall. A lump sum price can be shocking if the homeowner isn't prepared and could cause them to walk away. But a customer offered financing is more likely to engage in conversation with you to find a plan that meets their needs.

Financing also gives you opportunities to offer customers more premium roofing systems and warranties, as these options appear more affordable when they can be paid for over time. Companies who provide financing say that when presenting three tiers of pricing (referred to as "Good-Better-Best" comparison pricing), 80 % of the customers will choose the "Better" or "Best" categories. This can result in up to a 25 % increase in the price of the job.

Finally, financing gives you cash in hand. Once the project is complete, you can expect to get paid by the financing company quickly. This allows you to save money by taking advantage of early-payment discounts offered by material suppliers. That could be an extra 1-2 % in your pocket on each job.

How Contractor Financing Works

Contractor financing is a form of consumer financing, which is geared toward those who may have a hard time getting standard financing due to their credit history. It doesn't require as much personal information, can be applied for anywhere electronically, and is usually approved quickly.

Your company would be able to offer this financing with the aid of a third-party consumer financing company. The financing company would provide you with a rate sheet that details interest rates and how to calculate monthly payments and the lender costs associated with financing.

When pricing your jobs for financing, it is important to calculate margin instead of mark-up to keep profit percentages equal. Mark-up is a straight percentage added on to the cost of the project, while margin is the difference between the sales price and the cost of the project, expressed as a percentage of the sales price. You will need to add margin to your pricing to cover financing costs such as merchant fees and credit card fees, if applicable.

Once the project is complete and the financing is in place, the financing company would pay you for the work, often in as little as 3-5 days. After this, your work would be done.

Pour débuter

To get started, research consumer financing companies, such as GreenSky, to see which ones offer the best terms for your business. Once you find a good fit for you and your customers, submit an application with the financing company for approval and processing, which may take a few days.

After you've received approval, you'll want to set up a platform that makes it easy to submit payments, like GAF SmartMoney. Then, advertise your new financing options on your website, social media channels, and sales calls. You may find it beneficial to have your sales team role play a sales call, so they know what to say when offering financing to your potential customers.

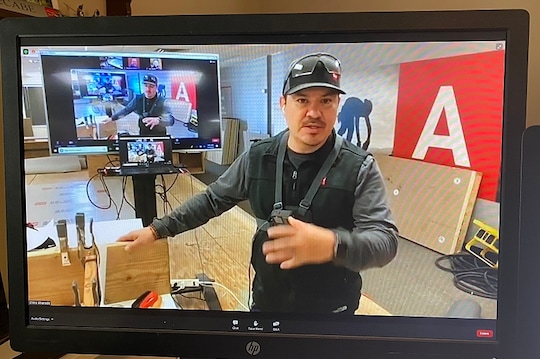

For more information on offering financing to your customers, see GAF's video lessons about consumer financing.

For more tips, tools and updates, see the GAF Contractor Resources for managing through the pandemic.